Our Role

The Federal Housing Administration (FHA) is part of the U.S. Department of Housing and Urban Development. We provide mortgage insurance on loans made by FHA-approved lenders. We insure mortgages on single family homes, multifamily properties, residential care facilities, and hospitals throughout the United States and its territories.

What We Do

FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal balance. Because lenders take on less risk, they are able to offer more mortgages to homebuyers.

To qualify for insurance, loans must meet certain requirements.

How We're Funded

| FHA primarily operates from its self-generated income. |

We collect mortgage insurance premiums from borrowers via lenders. We use this income to operate our mortgage insurance programs for the benefit of homebuyers, renters, and communities.

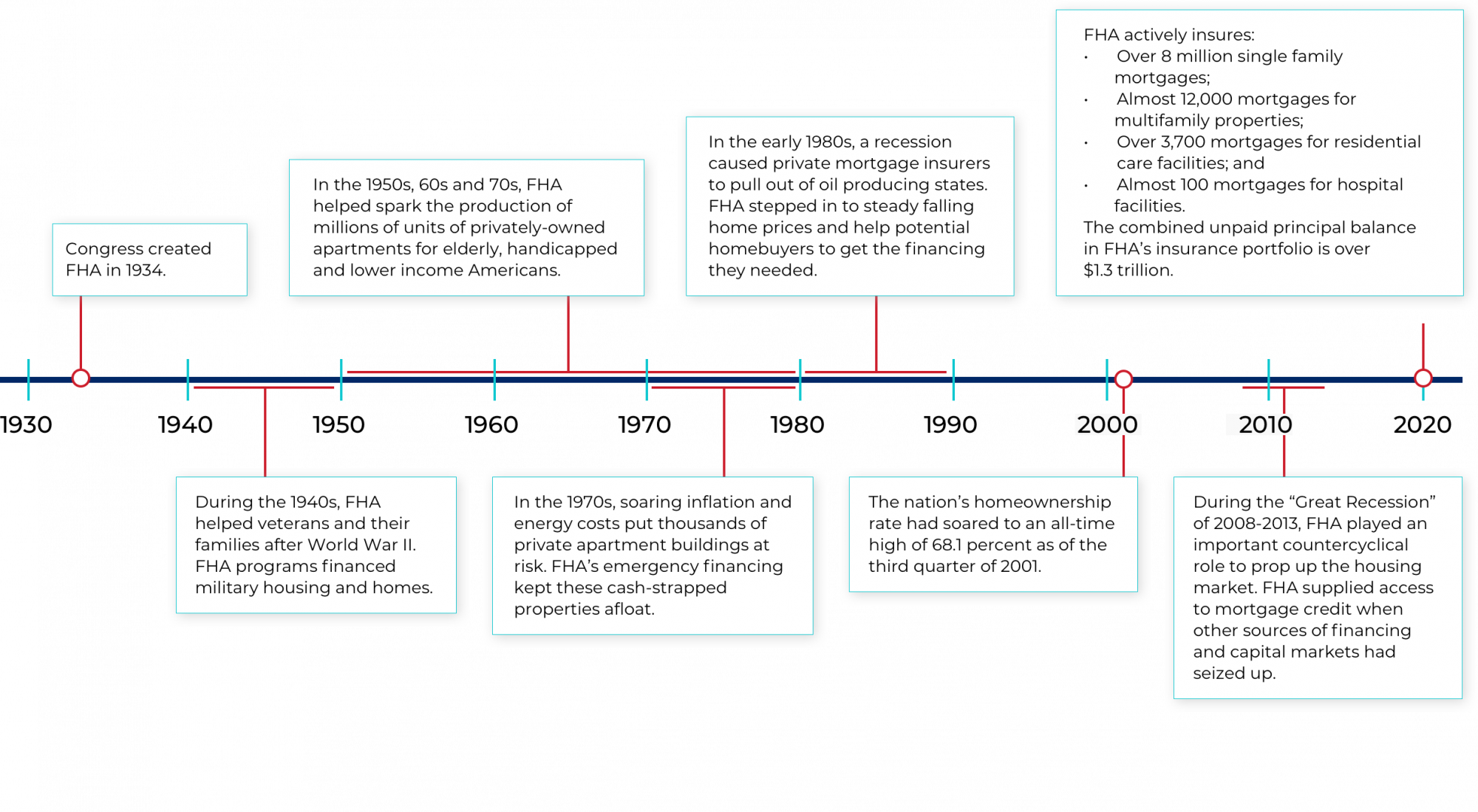

Our History

1934-1935

Congress created the FHA in 1934. At the time, the housing industry was flat on its back:

- 2 million construction workers had lost their jobs.

- Terms were difficult to meet for homebuyers seeking mortgages.

- Mortgage loan terms were limited to 50 percent of the property's market value. This included a repayment schedule spread over three to five years and ending with a balloon payment.

- America was mostly a nation of renters. Only 1 in 10 households owned homes.

FHA became a part of the Department of Housing and Urban Development's (HUD) Office of Housing in 1965.