Louisiana's car insurers have been given the green light by state regulators to increase rates across the board, with one of the largest companies hiking its average price by nearly 34%.

Insurance commissioner Jim Donelon cautioned drivers that the auto insurance system is complex and opaque, and said rates for some could be much higher than the average while others might actually see a decrease. He urged drivers to shop around for the most competitive price.

"We've been seeing significant rate increases driven by inflation for parts and labor all across America, so it is not any different here than elsewhere," Donelon said.

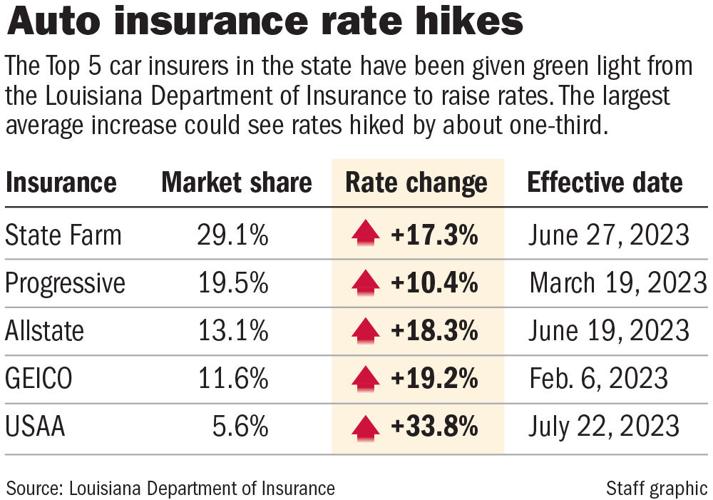

The average increase across all the state's auto insurers was just over 12% this year. For the top 5 companies by market share, the average increase was much higher, at 20%.

State Farm, which accounts for about one-third of the state's car insurance market, has been approved to increase its rates by an average 17.3%, according to Louisiana Department of Insurance data.

The average rate increase from Progressive, which has about one-fifth of the market, was just over 10%. Allstate is going up by more than 18%, GEICO by more than 19% and USAA by nearly 34%.

La. Insurance Commissioner Jim Donelon speaks in the House of Representatives on Feb. 1, 2023, as the state legislature considers his plan to stabilize the homeowners' insurance market.

Those benchmark rate increases are the average for personal auto insurance covering physical damage, liability and no-fault. Actual rate hikes can vary widely depending on individual circumstances and factors like "good driver" discounts.

Stoked by inflation

The car insurance increases come on top of huge increases for most Louisiana home insurance policies in the wake of a record series of hurricanes in 2020 and 2021. Some consumers have been unable to find policies after many companies pulled out of the market.

The car insurance increases, however, are driven by general national trends rather than anything specific to Louisiana.

Nichole Torblaa, Louisiana Department of Insurance's chief actuary, said given what has happened over the last few years, particularly the recent spurt of inflation, the rate hikes are not surprising.

"The price increases for the consumer certainly might be shocking, but what we're seeing from State Farm and the other insurers is not unexpected based on what we've seen across the country," Torblaa said.

In 2020, insurance companies cut their rates when the COVID pandemic kept many off the road. State Farm, for example, cut its average rate in Louisiana by just under 10%, then clawed that back with increases in 2021 and 2022. That means this year's increase is effectively a jump from the base rate in 2019.

The rate hikes come even as fatality rates from car crashes have been declining. The National Highway Traffic Safety Administration showed that fatalities fell by more than 9% in Louisiana last year, compared to a 0.3% decrease nationally.

Top of the heap

The latest round of rate hikes will keep Louisiana at or near the top of the charts for the most expensive car insurance in the nation. The state was the most expensive in 2020 with average rates of $1,495 per year, according to the latest assessment by the Insurance Information Institute, and has maintained the distinction of being in the top three most costly for decades.

Donelon said that high claims awards against insurance companies by Louisiana courts is a big factor keeping rates relatively high. "Our claims-to-litigation ratio since I was chairing the House Insurance Committee in the '90s has been the highest in America," Donelon said.

Because Louisiana's insurance market is fairly opaque, the car insurance increases that were approved earlier this year are only now coming to light.

The state is one of 20 in the country that has "prior approval" rules, in which insurance companies submit their proposals to change rates to the Louisiana Department of Insurance. These are typically approved within a month, but are not publicized unless the information is specifically requested.

Louisiana this year passed a new law that allows insurance companies to phase in their yearly increases for car policies, which typically are renewed every six months.

Donelon said previously companies could only issue one increase a year. The law allowing a phased-in approach was aimed at making it less likely that consumers would feel the increase and, therefore, be less likely to shop around for cheaper coverage.

Editor's Note: This story has been updated to correct the description of Commissioner Donelon's previous role.