Energy

Visualizing the World’s Largest Oil Producers

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The World’s Largest Oil Producers

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

The world is in the middle of the first energy crisis of the 21st century.

High energy prices, especially for oil, gas, and coal, are driving decades-high inflation in various countries, some of which are also experiencing energy shortages. Russia’s recent invasion of Ukraine has exacerbated the crisis, given that the country is both a major producer and exporter of oil and natural gas.

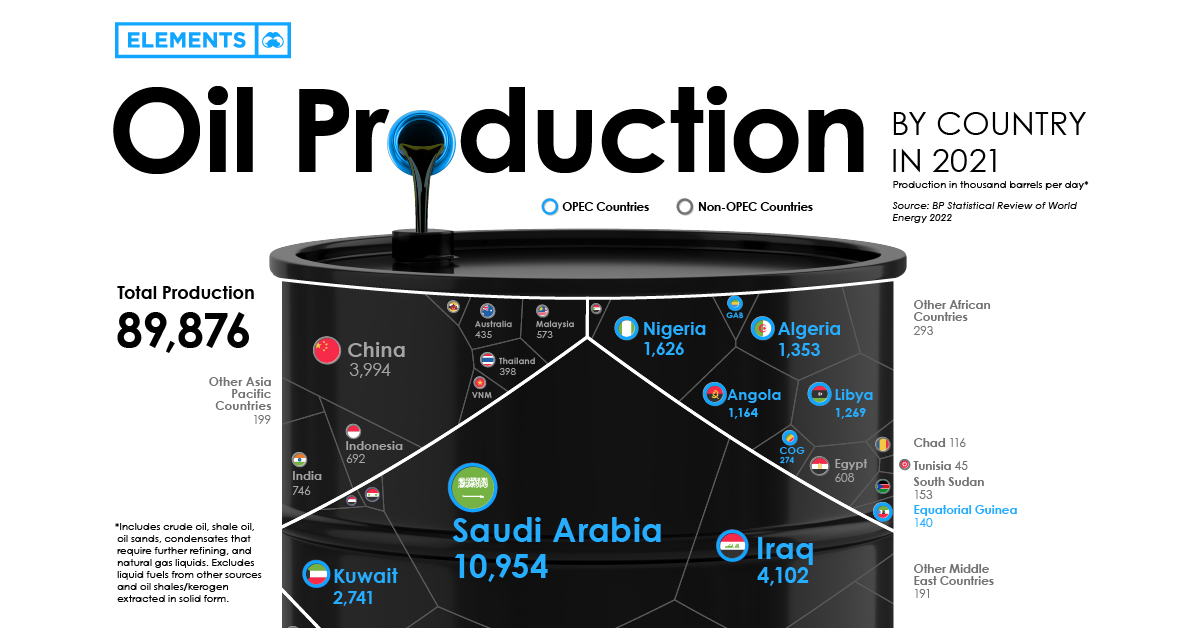

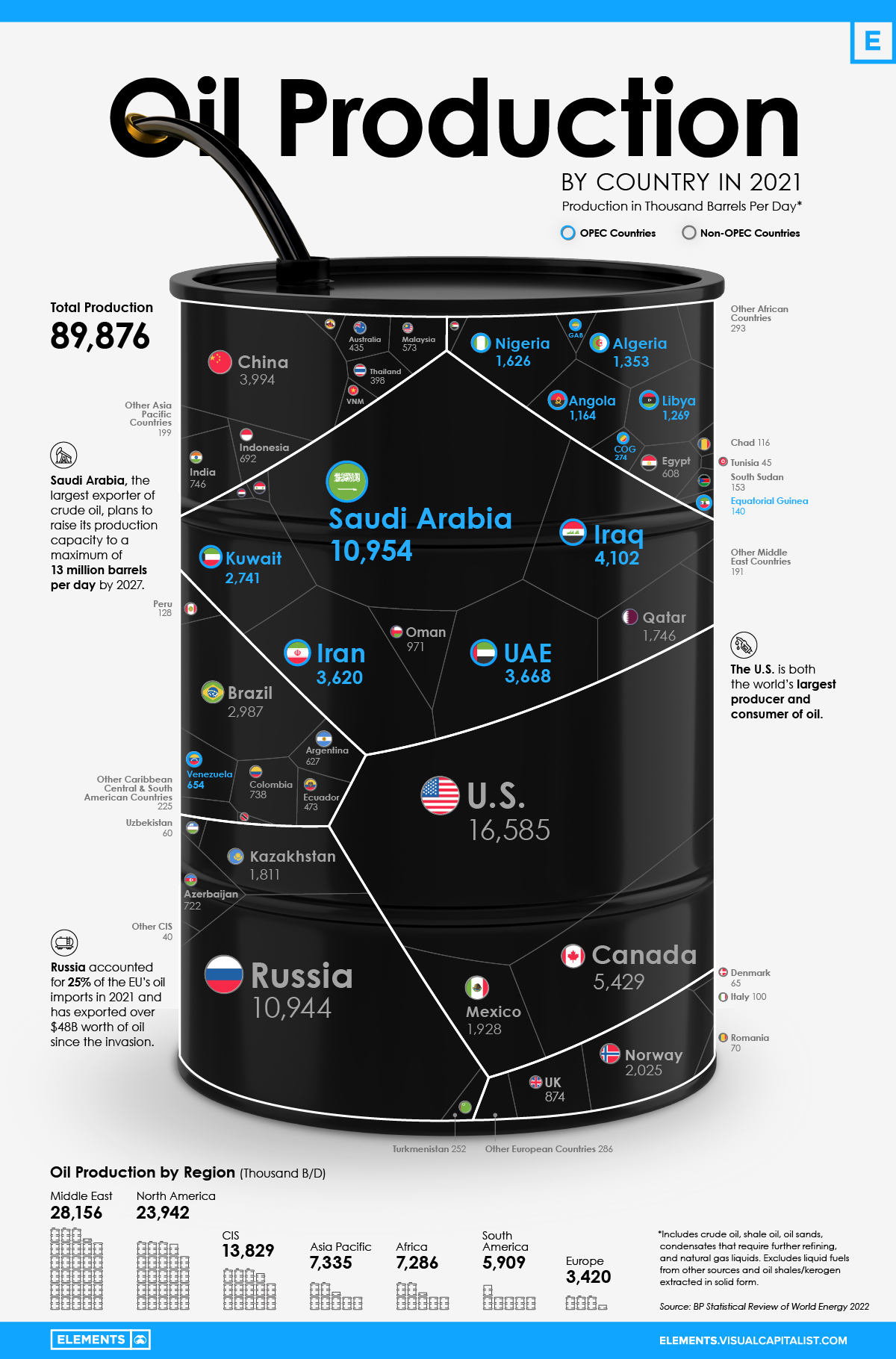

Using data from BP’s Statistical Review of World Energy, the above infographic provides further context on the crisis by visualizing the world’s largest oil producers in 2021.

Oil Production: OPEC Countries vs. Rest of the World

Before looking at country-level data, it’s worth seeing the amount of oil the Organization of Petroleum Exporting Countries (OPEC) produces compared to other organizations and regions.

| Region/Organization | 2021 Oil Production (barrels per day) | % of Total |

|---|---|---|

| OPEC | 31.7M | 35% |

| North America | 23.9M | 27% |

| Commonwealth of Independent States (CIS) | 13.8M | 15% |

| Rest of the World | 20.5M | 23% |

| Total | 89.9M | 100% |

The OPEC countries are the largest oil producers collectively, with Saudi Arabia alone making up one-third of OPEC production. It’s also important to note that OPEC production remains below pre-pandemic levels after the organization reduced its output by an unprecedented 10 million barrels per day (B/D) in 2020.

Following the OPEC countries, the U.S., Canada, and Mexico accounted for just over a quarter of global oil production in 2021. Nearly 70% of North American oil production came from the U.S., the world’s largest oil producer.

Similarly, within the CIS—an organization of post-Soviet Union countries—Russia was by far the largest producer, accounting for 80% of total CIS production.

The Largest Oil Producers in 2021

Roughly 43% of the world’s oil production came from just three countries in 2021—the U.S., Saudi Arabia, and Russia. Together, these three countries produced more oil than the rest of the top 10 combined.

| Country | 2021 Oil Production (barrels per day) | % of Total |

|---|---|---|

| U.S. 🇺🇸 | 16.6M | 18.5% |

| Saudi Arabia 🇸🇦 | 11M | 12.2% |

| Russian Federation 🇷🇺 | 10.9M | 12.2% |

| Canada 🇨🇦 | 5.4M | 6.0% |

| Iraq 🇮🇶 | 4.1M | 4.6% |

| China 🇨🇳 | 4.0M | 4.4% |

| United Arab Emirates 🇦🇪 | 3.7M | 4.1% |

| Iran 🇮🇷 | 3.6M | 4.0% |

| Brazil 🇧🇷 | 3.0M | 3.3% |

| Kuwait 🇰🇼 | 2.7M | 3.0% |

| Norway 🇳🇴 | 2.0M | 2.3% |

| Mexico 🇲🇽 | 1.9M | 2.1% |

| Kazakhstan 🇰🇿 | 1.8M | 2.0% |

| Qatar 🇶🇦 | 1.7M | 1.9% |

| Nigeria 🇳🇬 | 1.6M | 1.8% |

| Algeria 🇩🇿 | 1.4M | 1.5% |

| Libya 🇱🇾 | 1.3M | 1.4% |

| Angola 🇦🇴 | 1.2M | 1.3% |

| Oman 🇴🇲 | 0.97M | 1.1% |

| United Kingdom 🇬🇧 | 0.87M | 1.0% |

| India 🇮🇳 | 0.75M | 0.8% |

| Colombia 🇨🇴 | 0.74M | 0.8% |

| Azerbaijan 🇦🇿 | 0.72M | 0.8% |

| Indonesia 🇮🇩 | 0.69M | 0.8% |

| Venezuela 🇻🇪 | 0.65M | 0.7% |

| Argentina 🇦🇷 | 0.63M | 0.7% |

| Egypt 🇪🇬 | 0.60M | 0.7% |

| Malaysia 🇲🇾 | 0.57M | 0.6% |

| Ecuador 🇪🇨 | 0.47M | 0.5% |

| Australia 🇦🇺 | 0.44M | 0.5% |

| Thailand 🇹🇭 | 0.39M | 0.4% |

| Republic of Congo 🇨🇬 | 0.27M | 0.3% |

| Turkmenistan 🇹🇲 | 0.25M | 0.3% |

| Vietnam 🇻🇳 | 0.19M | 0.2% |

| Gabon 🇬🇦 | 0.18M | 0.2% |

| South Sudan 🇸🇩 | 0.15M | 0.2% |

| Equatorial Guinea 🇬🇳 | 0.14M | 0.2% |

| Peru 🇵🇪 | 0.13M | 0.1% |

| Chad 🇹🇩 | 0.12M | 0.1% |

| Brunei 🇧🇳 | 0.10M | 0.1% |

| Italy 🇮🇹 | 0.10M | 0.1% |

| Syria 🇸🇾 | 0.10M | 0.1% |

| Trinidad & Tobago 🇹🇹 | 0.08M | 0.1% |

| Romania 🇷🇴 | 0.07M | 0.1% |

| Yemen 🇾🇪 | 0.07M | 0.1% |

| Denmark 🇩🇰 | 0.07M | 0.1% |

| Sudan 🇸🇩 | 0.06M | 0.1% |

| Uzbekistan 🇺🇿 | 0.06M | 0.1% |

| Tunisia 🇹🇳 | 0.05M | 0.1% |

| Rest of the World 🌍 | 1.2M | 1.4% |

| Total | 89.9M | 100.0% |

Over the last few decades, U.S. oil production has been on a rollercoaster of troughs and peaks. After falling from its 1970 peak of 11.3 million B/D, it reached a historic low of 6.8 million B/D in 2008. However, following a turnaround in the 2010s, the country has since surpassed Saudi Arabia as the largest oil producer. As of 2021, though, the U.S. remained a net importer of crude oil while exporting refined petroleum products.

Saudi Arabia and Russia each produced roughly 11 million B/D in 2021 and were the two largest oil exporters globally. In both countries, state-owned oil firms (Saudi Aramco and Gazprom, respectively) were the most valuable oil and gas producing companies.

From Europe (excluding Russia), only Norway made the top 15 oil producers, accounting for 2.3% of global production. The lack of regional output partly explains the European Union’s dependence on Russian oil and gas, worsening the region’s energy crisis.

How the Energy Crisis is Affecting Oil Production

After a deep dive in 2020, oil demand is resurfacing and is now above pre-pandemic levels. Furthermore, supply constraints due to sanctions on Russian oil and gas tighten the market and support high oil prices.

While the impact has been felt globally, European countries have been hit hard due to their reliance on Russia’s fossil fuel exports, with some getting almost all of their energy fuels from Russia.

To combat the oil crunch, the rest of the world is ramping up oil supply through increased production or releasing strategic petroleum reserves (SPRs). U.S. oil production is expected to rise by 1 million B/D in 2022 to a record-high. Simultaneously, Western nations are calling on OPEC members to increase their output to ease prices. However, OPEC nations are sticking to their planned production hikes, with output still below early 2020 levels.

“We had a good discussion on ensuring global energy security and adequate oil supplies to support global economic growth. And that will begin shortly.”– U.S. President Joe Biden on his recent visit to Saudi Arabia

The U.S. is releasing 180 million barrels of oil from its SPR, of which 60 million barrels will contribute to the IEA’s collective release of 120 million barrels. But with oil demand expected to reach a new all-time high in 2023, it remains to be seen whether these efforts to increase supply will be enough to curb the crunch.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) |

Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Misc1 week ago

Misc1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Environment1 week ago

Environment1 week agoTop Countries By Forest Growth Since 2001

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue